Knowing the distinction helps in accurate budgeting and financial planning, ensuring you have a clear picture of your actual disposable income.

This article will clarify how each type of pay is calculated and why it is essential to understand the difference.

Let’s Start With Key Differences

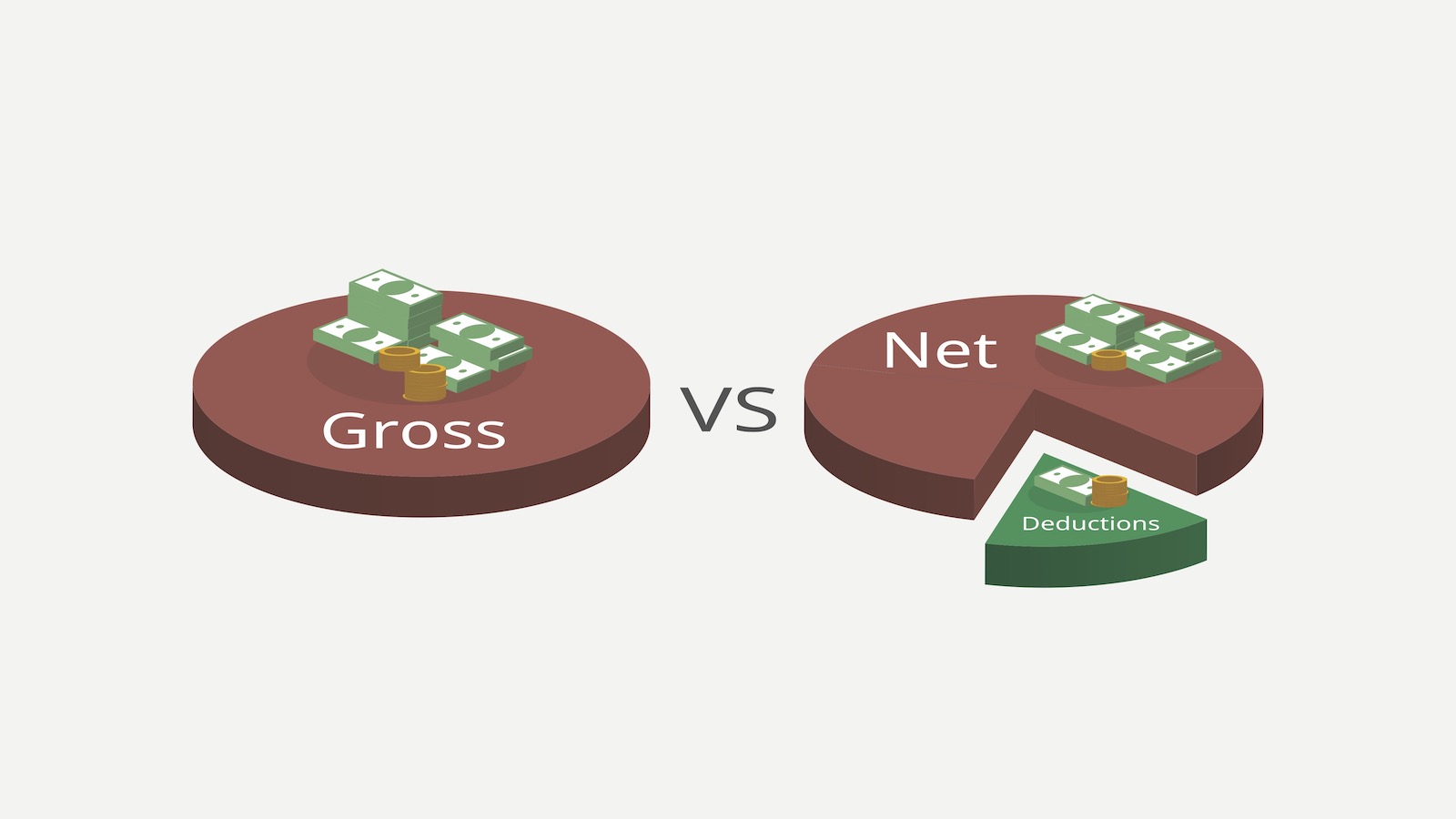

Here’s a simple breakdown:

- Gross Pay: This is your total earnings before any deductions. It includes your salary or hourly wages plus any bonuses, overtime, or commissions.

- Net Pay: This is what you actually take home after all deductions. These deductions can include taxes, Social Security, Medicare, health insurance, and retirement contributions.

If you earn $4,000 a month (gross pay) and have $1,200 in deductions, your net pay (take-home pay) would be $2,800.

Gross pay is the starting point, and net pay is what you end up with after all necessary deductions. Understanding this helps you manage your finances better by knowing exactly how much money you will have available to spend.

Definition of Gross Pay

Gross pay is your total earnings before any deductions. It includes:

- Base Salary or Hourly Wages: The agreed-upon amount for your job.

- Bonuses: Extra compensation based on performance or achievements.

- Commissions: Earnings based on sales or other metrics.

- Overtime Pay: Additional pay for hours worked beyond the regular schedule.

- Tips: Additional earnings from customers, common in service industries.

Components of Gross Pay:

- Base salary or hourly wages

- Overtime pay

- Bonuses

- Commissions

- Tips

If an employee has an annual salary of $50,000, their gross pay would be calculated as follows: For an hourly employee who works 40 hours a week at $20 per hour:

Definition of Net Pay

Net pay is the amount you take home after all deductions. These deductions can include:

- Federal, State, and Local Taxes: Income taxes based on your earnings.

- Social Security and Medicare Taxes: Contributions to federal programs.

- Health Insurance Premiums: Payments for your health insurance coverage.

- Retirement Contributions: Money set aside for retirement plans like a 401(k).

- Other Deductions: Union dues, charitable donations, wage garnishments, etc.

Components of Net Pay:

- Base salary or hourly wages after deductions

- Additional earnings after deductions

- The final amount received by the employee

If an employee’s gross pay is $4,166.67 per month and the total deductions amount to $1,200, their net pay would be:

How to Calculate Gross Pay

For Salaried Employees

Use the formula: Annual Gross Salary / Number of Pay Periods

For Hourly Employees

Use the formula: Hourly Rate * Hours Worked

How to Calculate Net Pay

Net pay is calculated by subtracting all deductions from the gross pay.

Formula:

Gross Pay - Total Deductions

Common Deductions from Gross Pay

- Federal income tax

- State and local income tax

- Social Security tax

- Medicare tax

- Health insurance premiums

- Retirement contributions

- Wage garnishments

Examples of Gross Pay Calculations

Salaried Employee

Annual salary: $60,000

- Monthly gross pay: $60,000 / 12 = $5,000

- Bi-weekly gross pay: $60,000 / 26 = $2,307.69

Hourly Employee

Hourly rate: $20, Hours worked: 40

- Weekly gross pay: $20 * 40 = $800

Examples of Net Pay Calculations

Salaried Employee

Monthly gross pay: $5,000

- Deductions: $1,200

- Net pay: $5,000 – $1,200 = $3,800

Hourly Employee

Weekly gross pay: $800

- Deductions: $200

- Net pay: $800 – $200 = $600

Frequently Asked Questions

Last Words

Understanding the difference between gross and net pay is crucial for financial planning. Gross pay gives an overview of total earnings, while net pay provides the actual amount available for spending and saving. Knowing this distinction helps in budgeting and making informed financial decisions.