It’s never too early to start teaching your kids about money, and you can make it fun! You don’t necessarily need to start with textbooks because the right fiction books will work perfectly.

Additionally, playtime can be just as educational as it is fun! Here are some tips and tricks for how to teach kids about money using fiction titles like the Tuttle Twins books and play.

How to Teach Kids About Money ─ Laying the Foundation

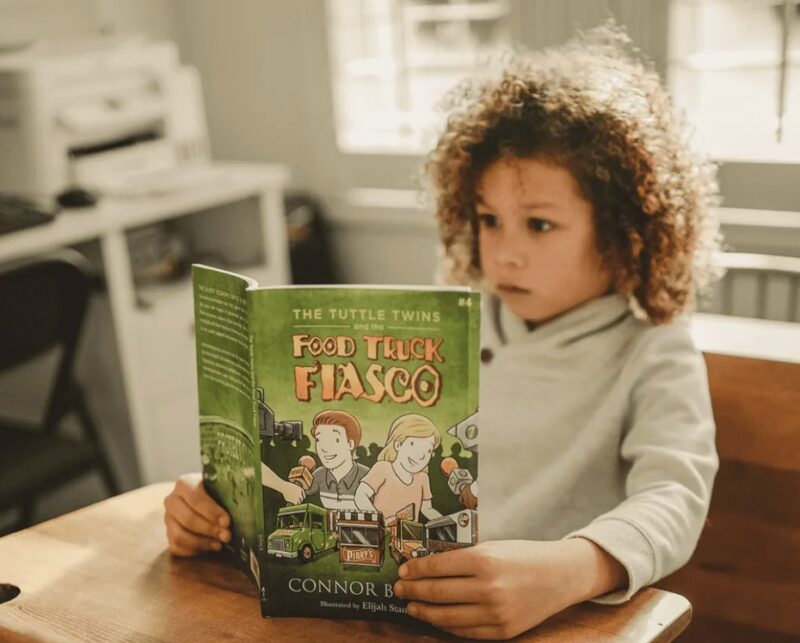

Fiction books are a great starting point for teaching children about money. Through engaging stories, the series introduces key financial ideas in a way kids can easily grasp. These books also provide a simple and relatable way to explain free market principles and how money works in everyday life.

At this point you might be wondering why fiction is often a better place to start with younger kids rather than non-fiction books about money. Younger kids need to be engaged right from the start, and the best way to do that is by telling them an exciting story!

Books or kids wrap every lesson about money into an amazing adventure they won’t soon forget. Some books that teach kids about inflation, money, economics, and the free market include:

- The Tuttle Twins and the Creature from Jekyll Island

- Whatever Happened to Penny Candy? by Richard J. Maybury

- If You Made a Million by David M. Schwartz

Using Play to Teach Kids About Money

When talk of playtime rolls around, it’s natural to think of board games that will help show how to teach kids about money, like Monopoly. But you don’t have to stop there. You can get really creative with some of these exciting activities that will make playtime educational while enhancing the fun!

You can teach about inflation, the free market, budgeting, and more by setting up a pretend store and giving your kids play money to spend. Let your kids play both the shopper and shopkeeper roles to see how things work.

Pay real money to your kids in exchange for chores and help them with budgeting it for savings, spending, and giving. Use the three-jar method as a visual aid to help with this and give them rewards when their savings reaches certain milestones.

Go on fun shopping trips and allot your child a certain amount of money to spend, preferably from their own cash stash from doing chores. You can even encourage entrepreneurship in your kids by helping them brainstorm ideas for a business to make some extra cash!

Reinforcing What They Learn Through Play

These are some fun ways to pique your child’s interest in money, but you can go even further by introducing a curriculum. After all, many schools don’t even teach about money until high school, if they do at all. It’s best to get these lessons in early so that your child will be set up for success.

Making Everyday Moments Count

Not every money lesson has to be formal. Some of the most effective teaching moments happen in everyday life, at the grocery store, the gas station, or even during family outings. Take these moments to explain why you choose one product over another or how discounts work.

For instance, when you pay at the register, let your child hand over the cash or card. If they’re old enough, show them the receipt and talk about taxes or change. These little experiences build comfort and curiosity around handling money. Over time, this casual approach develops a sense of financial awareness far stronger than a single “money talk.”

Age-Appropriate Money Lessons

Money education should grow with your child. Preschoolers won’t understand interest rates, but they can grasp the concept of earning and saving. As they grow older, you can gradually add new topics.

Here’s a simple progression:

- Ages 3–6: Focus on identifying coins and bills, simple trade, and understanding that things cost money.

- Ages 7–10: Introduce saving goals, needs vs. wants, and the idea of earning through chores or projects.

- Ages 11–13: Discuss concepts like budgeting, inflation, and supply and demand using stories.

- Teens: Move toward deeper discussions about credit, entrepreneurship, and investing basics.

Each stage builds naturally on the last, ensuring your child develops a confident, age-appropriate understanding of how money works.

Why Fiction Helps Kids Absorb Complex Ideas

Children often absorb lessons from stories more deeply than from lectures. Fiction allows them to see the consequences of choices in a safe, imaginative environment. When characters in books face money-related challenges, like earning, losing, or sharing, it helps children internalize abstract ideas like value, fairness, and responsibility.

That’s the beauty of books like The Tuttle Twins and the Creature from Jekyll Island, which explains the idea of money creation through an adventure story. The moral lessons blend seamlessly with economic education, and because the story entertains, the knowledge sticks. This is what makes fiction-based learning such a powerful complement to real-life experiences.

Encouraging Reflection After Reading or Play

After finishing a book or game, have a short chat about what your child learned. Ask open-ended questions like:

- What part of the story or game felt most exciting?

- How did the characters or players make decisions about money?

- What would they do differently next time?

This reflection turns abstract lessons into real understanding. It also helps your child connect what they read or played to their own daily experiences, saving for a toy, making change, or earning money for helping around the house.

Building Lifelong Financial Confidence

By using fiction and play as your teaching tools, you’re not just teaching about money; you’re shaping attitudes. Children who learn through engaging, hands-on experiences are less likely to fear financial responsibility later in life. They’ll see money as something to manage thoughtfully rather than something mysterious or stressful.

Start small, stay consistent, and remember: every book, game, and conversation counts. The earlier you introduce these ideas, the more confident and capable your child will become in managing their own future.